Bank Stamps: The Essential Guide to Streamlining Financial Transactions

In today’s fast-paced banking and finance world, accuracy and efficiency are crucial. One often overlooked yet vital tool that ensures smooth, secure transactions and reliable record-keeping is the bank stamp. Whether you’re involved in daily banking operations, managing a financial institution, or running a related business, understanding the role and benefits of bank stamps can bring clarity and ease to your processes.

This guide dives deep into what bank stamps are, why they matter, the types commonly used in banks, how to choose the right one, and practical tips for maximizing their benefits. Along the way, we’ll explore how digital innovations and customization options are shaping the future of bank stamping, empowering banks and businesses alike to stay efficient and compliant.

What Are Bank Stamps?

Bank stamps are custom-designed rubber or electronic stamps used by banks and financial institutions to mark documents, verify transactions, and maintain official records. They can include important information such as transaction status, account numbers, dates, signatures, and bank logos.

At a glance, bank stamps serve as a trusted physical or digital mark that authenticates documents—be it checks, deposit slips, payment authorizations, or official bank correspondence. By clearly indicating approval, processing, or other transaction details, these stamps help prevent errors, fraud, and delay.

Read More:-create a stamp online

Why Bank Stamps Matter

Verification and Security

Bank stamps act as an official seal of approval, confirming that financial transactions are legitimate and have been authorized by the right personnel. This visual verification reduces the chances of forgery and unauthorized activities, which is particularly critical when handling sensitive data such as account information or payment authorizations.

Efficiency and Time Savings

Instead of manually writing approval notes or transaction details, bank stamps offer a quick way to mark documents consistently and accurately. This speeds up processing time in busy banking environments, supports frontline staff, and minimizes errors that can occur with handwritten entries.

Reliable Record-Keeping

A bank’s documentation often requires clear evidence of when and how transactions occurred. Stamps—often bearing dates, codes, or transaction notes—help maintain an organized, standardized record trail that aids audits, compliance checks, and customer service inquiries.

Read More:-design a perfect round stamp

Common Types of Bank Stamps

To cater to various banking needs, several specific types of bank stamps are in use across financial institutions:

- Endorsement Stamps: Used mainly on checks to endorse payment and designate them as “For Deposit Only” or to specify an account number. These stamps secure the check so it can only be credited to the named account.

- Deposit Stamps: Applied to deposit slips to confirm the date and amount of money deposited, facilitating the deposit process and providing a proof of transaction for both the customer and bank staff.

- Received Stamps: Mark documents to show they have been officially received by the bank on a specific date, supporting accurate communication and follow-up.

- Signature Stamps: Used by authorized bank personnel to replicate their signature for processing routine documents efficiently while maintaining security.

- Security Stamps: Contain additional anti-fraud features such as tamper-evident ink, microtext, or UV markings to protect sensitive documents from being altered or copied without detection.

How to Choose the Right Bank Stamp

Selecting the best bank stamp depends on your institution’s or business’s unique requirements. Here are key factors to consider:

1. Purpose and Usage Volume

Identify the primary purpose of your stamp: Is it for endorsements, deposits, general approvals, or security purposes? Also, estimate how frequently it will be used to choose a model designed for high or low-volume stamping.

2. Design and Customization

Look for options to personalize your stamp with essential details such as bank name, account numbers, logos, and custom messages. Clear, legible fonts and accurate alignment contribute to professionalism and usability.

3. Stamp Type

Decide between traditional rubber stamps, pre-inked stamps, or electronic stamps. Pre-inked stamps offer cleaner impressions and longer ink life, while electronic stamps provide faster, repeatable digital marks ideal for high-volume tasks.

4. Security Features

Depending on your banking context, opt for stamps with anti-fraud elements—such as microtext or tamper-evident patterns—to enhance document security and deter forgery.

5. Ink and Visibility

Black ink is standard for most banking stamps due to its strong visibility and legibility. However, some specialized stamps may use different ink colors suitable for particular document types or compliance requirements.

Benefits of Custom Bank Stamps

Custom bank stamps tailored to your exact needs provide several advantages:

- Brand Consistency: Incorporating your bank’s logo and style in the stamp maintains a professional and branded document appearance.

- Operational Accuracy: Customized stamps reduce errors by standardizing the text and layout, ensuring every document is stamped correctly.

- Regulatory Compliance: Including specific legal or registration information supports adherence to financial regulations and audit readiness.

Digital Evolution: Electronic Bank Stamps

The banking industry is rapidly embracing digital solutions, and electronic bank stamps are becoming more prevalent. These stamps automate repetitive stamping tasks, ensure consistent branding, and boost processing speed without sacrificing security.

Electronic stamps generate secure, verifiable impressions on digital documents or scanned paperwork, supporting remote banking and reducing physical handling risks. Many institutions combine traditional rubber stamps for physical documents with electronic ones for digital workflows.

Practical Tips for Using Bank Stamps Effectively

- Regular Maintenance: Keep rubber stamps clean and replace ink pads or cartridges as needed to maintain crisp, clear impressions.

- Secure Storage: Safeguard stamps from unauthorized access to protect against misuse or fraud.

- Staff Training: Ensure employees are trained on correct stamping practices and understand the importance of stamp security.

- Backup Designs: Keep digital copies of your custom stamp designs for quick reordering or recreation.

Why Bank Stamps Still Matter in the Digital Age

While digital banking grows, physical documentation remains integral in many transactions due to legal requirements, customer preferences, and security concerns. Bank stamps bridge the gap between old and new by providing a trusted, tangible mark of authenticity.

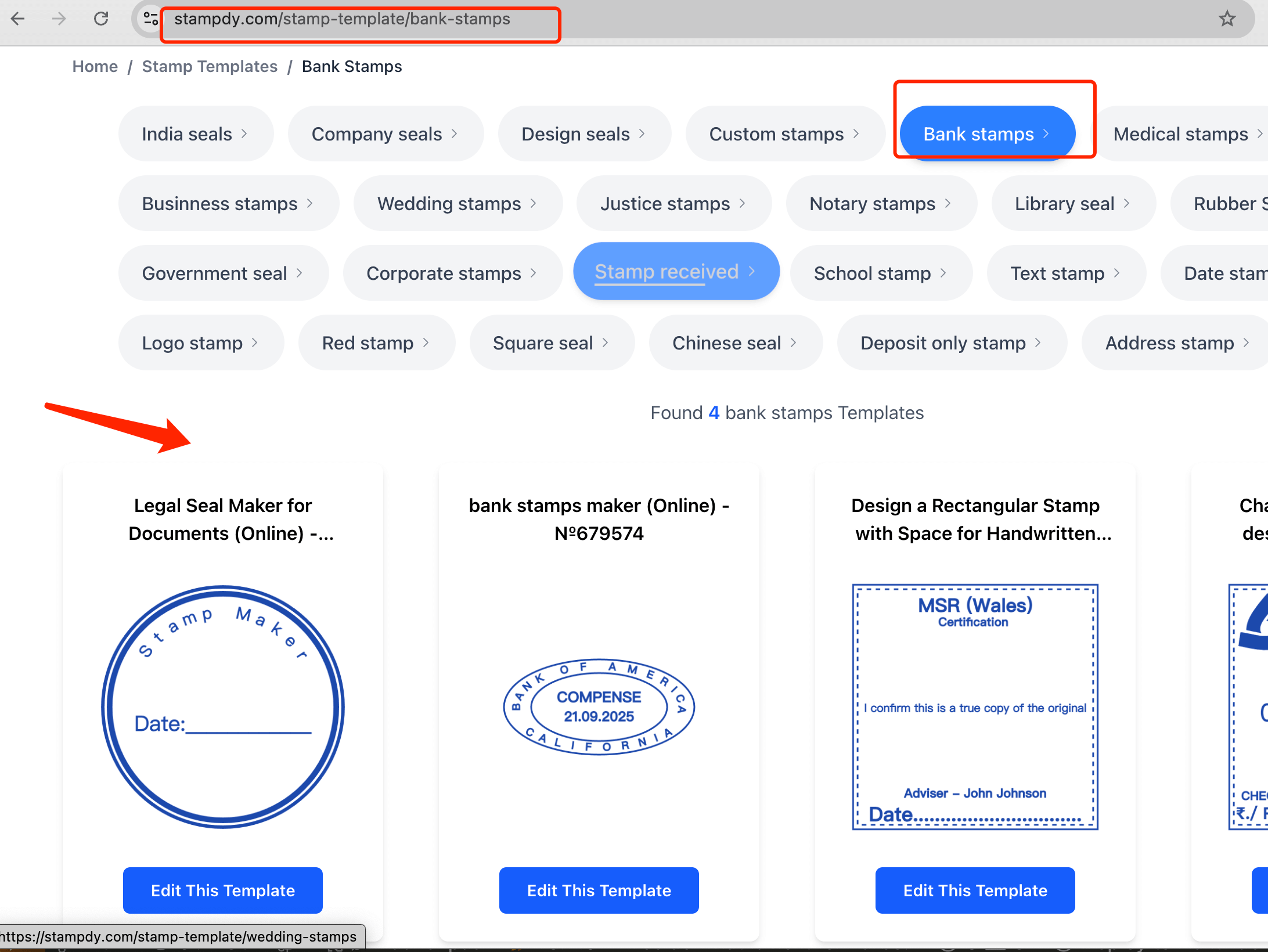

Moreover, customized stamps from reliable online makers, like StampDy, give you flexibility and control—letting you create professional bank stamps in minutes without any design skills.

How to Design Your Custom Bank Stamp Online

Using an online stamp maker simplifies the entire custom stamp creation process:

- Choose your preferred shape (round, square, or rectangle).

- Enter your bank or business details, account numbers, and any legal text required.

- Add logos or symbols to reinforce your brand identity.

- Adjust font style, size, spacing, and alignment with live previews.

- Download your design instantly in versatile formats like SVG, PNG, or PDF for printing or digital use.

This all-in-one approach reduces dependence on costly print shops and speeds up stamp production with full creative control from your browser.